- Financial, Lifestyle

Pag Seaman Mayaman? Here’s How to Make it True with Thoughtful Planning

- Financial, Lifestyle

Pag Seaman Mayaman? Here’s How to Make it True with Thoughtful Planning

In the Philippines, there’s a stereotype that seafarers are automatically wealthy, with the saying “pag seaman mayaman” suggesting that all seafarers live in luxury. While seafarers do earn a good salary, it’s crucial to manage that income properly. Without careful financial planning, even a high-paying job won’t guarantee a secure future. This guide will provide you with practical steps and insights to help you make informed financial decisions and work toward a stable financial future, whether you’re working at sea or on shore.

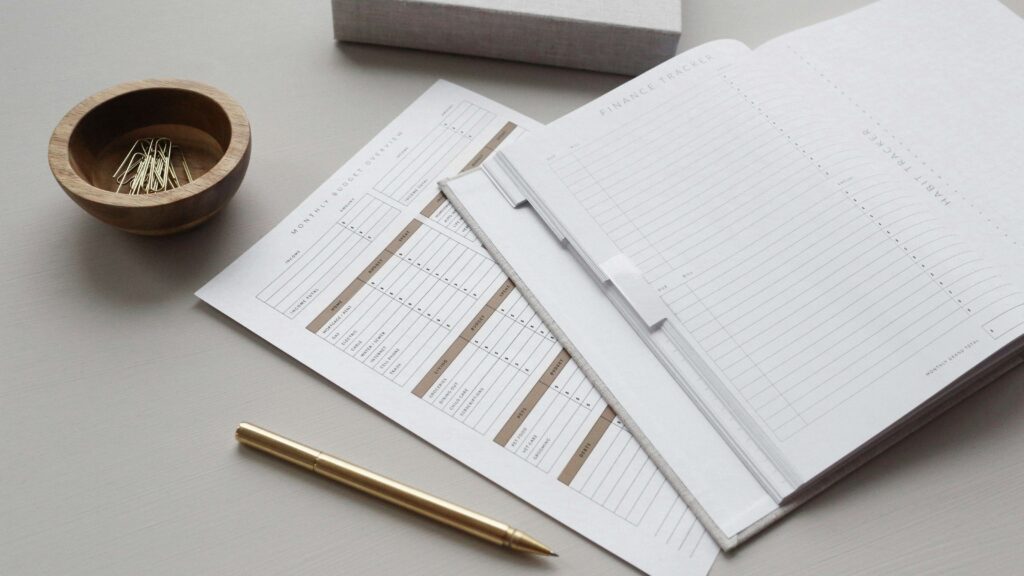

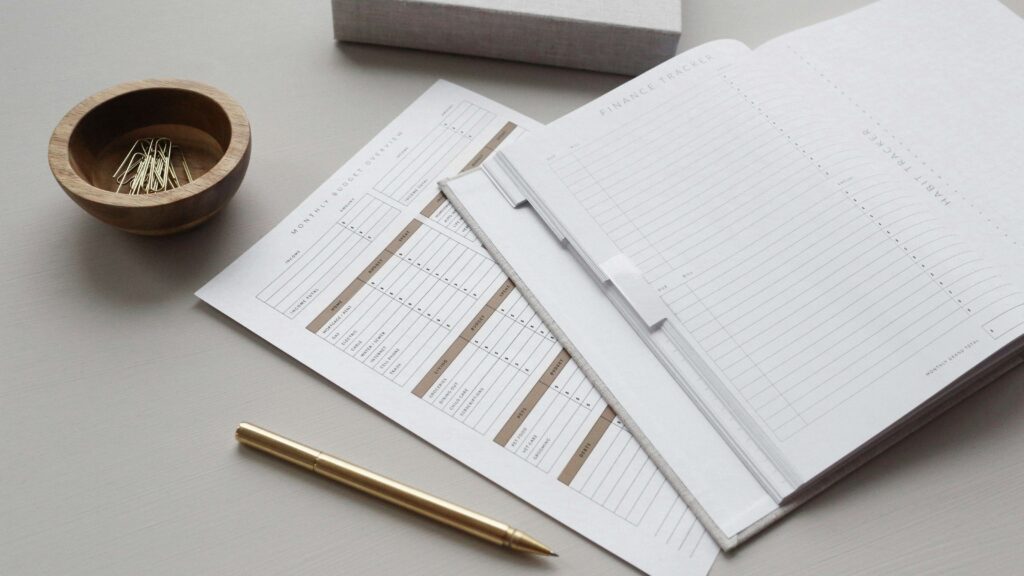

1. Create a Budget: Know Where Your Money Goes

Your salary may change depending on your job, so it’s important to know how much you earn and spend.

- Track your income and expenses. Write down how much you earn and how much you spend each month.

- Make a budget. Decide how much money you’ll spend on bills, food, savings, and fun. This will help you stay on track.

- Pay bills on time. Set up automatic payments or ask someone you trust to help pay bills while you’re at sea.

- Save for when you return home. Don’t forget to save money for vacations and other expenses when you come back from a trip.

2. Use Credit Carefully: Don’t Get Into Debt

It’s easy to use credit cards, but if you’re not careful, you could end up in debt.

- Know your credit score. Keep track of your credit score so you know if you’re borrowing too much.

- Be careful with borrowing. Only borrow money if you can pay it back on time.

3. Saving for Training and Certification Expenses

As a seafarer, you need to keep up with training and certifications to stay employed. But this can cost a lot, so it’s important to plan for it.

- Create a training fund. Set up a savings account just for your training and certification fees. This way, you won’t use the money you need for other things.

- Look for government help. The Maritime Industry Authority (MARINA) can offer programs to help cover some of your training costs.

- Look for scholarships. Some organizations like the Propeller Club of Manila and K Line Maritime Academy offer scholarships to help with training costs.

4. Start Saving Now: Secure Your Future

Saving money is important for emergencies, big purchases, and long-term goals.

- Save for emergencies. Life at sea can be unpredictable, so having savings for emergencies will help you feel safe.

- Save for big plans. If you want to buy a house or pay for your kids’ education, start saving now. The sooner you start, the easier it will be.

- Invest for the future. Think about your retirement and start saving for it now. Use programs like SSS (Social Security System) or Pag-IBIG Fund to save money for the long term.

5. Plan for Retirement: Make Sure You’re Ready

Planning for your retirement is important so you can live comfortably when you stop working at sea.

- Save for retirement. Start saving regularly for retirement. The more you save now, the better off you’ll be later.

- Avoid debt. Pay off any debts and avoid getting into more debt.

- Invest for the future. Think about starting a business or investing in something that will help you earn money even when you’re not working.

To prepare for your retirement, you can utilize government programs like the Social Security System (SSS) and the Pag-IBIG Fund, which offer savings and investment options tailored for Filipino workers.

- Social Security System (SSS): The SSS provides various programs to help members save for retirement, including the Workers’ Investment and Savings Program (WISP), which offers a 7.2% annual rate of return. Additionally, the MySSS Pension Booster allows members to enhance their retirement savings with a minimum contribution of P500.

- Pag-IBIG Fund: The Pag-IBIG Fund offers a Modified Pag-IBIG II (MP2) savings program, providing higher annual dividends compared to regular savings accounts. Members can also access housing loans and other benefits.

By participating in these programs, you can build a solid financial foundation for your retirement years.

6. Take Advantage of OWWA Benefits

As of 2025, seafarers can also rely on the Overseas Workers Welfare Administration (OWWA), which provides retirement benefits to Filipino workers in the maritime industry.

What you get from OWWA:

- OWWA offers a seafarer’s pension once you reach the age of 60, and this pension is available to members who have made continuous contributions.

- OWWA also provides health benefits, life insurance, and scholarships for your children.

Be sure to regularly contribute to OWWA so that you can take advantage of these benefits when you retire.

Taking control of your finances might not seem as exciting, but it’s one of the best ways to ensure a secure future. With a bit of planning and some smart decisions, you’ll be well on your way to making “pag seaman mayaman” a reality.

Comment Section

About Parola

Parola is a multimedia arts capstone project created by a small team of students from De La Salle-College of St. Benilde. It features a docuseries, informational materials, and visual content designed especially for Filipino seafarers and their loved ones.

Inspired by the Filipino word for ‘lighthouse’, Parola wants to be a guiding light for those navigating life at sea.

Our Other Articles

Article References

Maritime Industry Authority (MARINA)

Propeller Club of Manila Scholarship Programs

K Line Maritime Academy Scholarships

Social Security System (SSS)

Pag-IBIG Fund

In the Philippines, there’s a stereotype that seafarers are automatically wealthy, with the saying “pag seaman mayaman” suggesting that all seafarers live in luxury. While seafarers do earn a good salary, it’s crucial to manage that income properly. Without careful financial planning, even a high-paying job won’t guarantee a secure future. This guide will provide you with practical steps and insights to help you make informed financial decisions and work toward a stable financial future, whether you’re working at sea or on shore.

1. Create a Budget: Know Where Your Money Goes

Your salary may change depending on your job, so it’s important to know how much you earn and spend.

- Track your income and expenses. Write down how much you earn and how much you spend each month.

- Make a budget. Decide how much money you’ll spend on bills, food, savings, and fun. This will help you stay on track.

- Pay bills on time. Set up automatic payments or ask someone you trust to help pay bills while you’re at sea.

- Save for when you return home. Don’t forget to save money for vacations and other expenses when you come back from a trip.

2. Use Credit Carefully: Don’t Get Into Debt

It’s easy to use credit cards, but if you’re not careful, you could end up in debt.

- Know your credit score. Keep track of your credit score so you know if you’re borrowing too much.

- Be careful with borrowing. Only borrow money if you can pay it back on time.

3. Saving for Training and Certification Expenses

As a seafarer, you need to keep up with training and certifications to stay employed. But this can cost a lot, so it’s important to plan for it.

- Create a training fund. Set up a savings account just for your training and certification fees. This way, you won’t use the money you need for other things.

- Look for government help. The Maritime Industry Authority (MARINA) can offer programs to help cover some of your training costs.

- Look for scholarships. Some organizations like the Propeller Club of Manila and K Line Maritime Academy offer scholarships to help with training costs.

4. Start Saving Now: Secure Your Future

Saving money is important for emergencies, big purchases, and long-term goals.

- Save for emergencies. Life at sea can be unpredictable, so having savings for emergencies will help you feel safe.

- Save for big plans. If you want to buy a house or pay for your kids’ education, start saving now. The sooner you start, the easier it will be.

- Invest for the future. Think about your retirement and start saving for it now. Use programs like SSS (Social Security System) or Pag-IBIG Fund to save money for the long term.

5. Plan for Retirement: Make Sure You’re Ready

Planning for your retirement is important so you can live comfortably when you stop working at sea.

- Save for retirement. Start saving regularly for retirement. The more you save now, the better off you’ll be later.

- Avoid debt. Pay off any debts and avoid getting into more debt.

- Invest for the future. Think about starting a business or investing in something that will help you earn money even when you’re not working.

To prepare for your retirement, you can utilize government programs like the Social Security System (SSS) and the Pag-IBIG Fund, which offer savings and investment options tailored for Filipino workers.

- Social Security System (SSS): The SSS provides various programs to help members save for retirement, including the Workers’ Investment and Savings Program (WISP), which offers a 7.2% annual rate of return. Additionally, the MySSS Pension Booster allows members to enhance their retirement savings with a minimum contribution of P500.

- Pag-IBIG Fund: The Pag-IBIG Fund offers a Modified Pag-IBIG II (MP2) savings program, providing higher annual dividends compared to regular savings accounts. Members can also access housing loans and other benefits.

By participating in these programs, you can build a solid financial foundation for your retirement years.

6. Take Advantage of OWWA Benefits

As a seafarer, you can also rely on the Overseas Workers Welfare Administration (OWWA), which provides retirement benefits to Filipino workers in the maritime industry.

What you get from OWWA:

- OWWA offers a seafarer’s pension once you reach the age of 60, and this pension is available to members who have made continuous contributions.

- OWWA also provides health benefits, life insurance, and scholarships for your children.

Be sure to regularly contribute to OWWA so that you can take advantage of these benefits when you retire.

Taking control of your finances might not seem as exciting, but it’s one of the best ways to ensure a secure future. With a bit of planning and some smart decisions, you’ll be well on your way to making “pag seaman mayaman” a reality.

Comment Section

About Parola

Parola is a multimedia arts capstone project created by a small team of students from De La Salle-College of St. Benilde. It features a docuseries, informational materials, and visual content designed especially for Filipino seafarers and their loved ones.

Inspired by the Filipino word for ‘lighthouse’, Parola wants to be a guiding light for those navigating life at sea.

Our Other Articles

Article References

Maritime Industry Authority (MARINA)

Propeller Club of Manila Scholarship Programs

K Line Maritime Academy Scholarships

Social Security System (SSS)

Pag-IBIG Fund

Parola

This website serves as a thesis capstone project that aims to create resources for those working in the maritime industry, and their loved ones back at home.

Get in touch with us!

kamusta.parola@gmail.com

950 P. Ocampo St., Malate, Manila 1004

Created by Agsaway, Cruz, Javier, Salonga, and Tumang

© 2025. Parola. All Rights Reserved.

Parola

This website serves as a thesis capstone project that aims to create resources for those working in the maritime industry, and their loved ones back at home.

Created by Agsaway, Cruz, Javier, Salonga, and Tumang

© 2025. Parola. All Rights Reserved.